On December 14, the FCC repealed regulations that prevented broadband Internet providers from blocking or upcharging certain sites or content on the Internet. The motive behind the deregulation, according to FCC Chairman Ajit Pai, is to support a free-market environment and promote competition among broadband companies that will ultimately benefit the consumer.

However, opponents of the deregulation fear higher Internet fees falling back to content consumers, and in the most dire case, the telecom conglomerates controlling the information flow to consumers, effectively stifling certain political voices.

They argue there isn’t enough competition in the telecom space to motivate broadband companies to act in the interest of the consumer. An example of this is when AT&T blocked usage of Apple’s FaceTime unless users were on a certain data plan back in 2012.

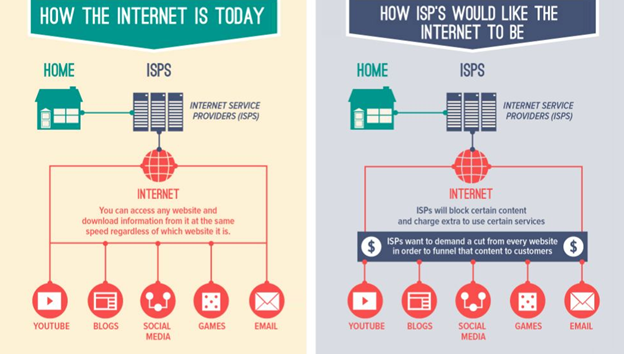

Here is a great infographic from Digital Information World that sums it up:

So, consumers’ Internet packages from their ISP (Internet Service Provider) could look like this:

• Social Media Bundle! High-speed access to Facebook, Twitter and Gmail for as low as $10.99/month!

• Content Bundle! High-speed access to Netflix and Hulu for just $12.99/month!

• Bronze package! Including the following 50 websites for just $29.99/month!

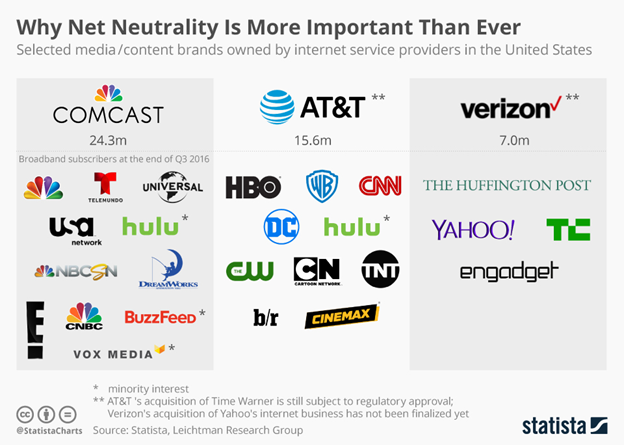

If consumers don’t buy the packages, content that falls outside of their “bundle” will be slowed or even blocked. And, if you take a look at who owns what, you can see how this could be even easier based on the conglomerations in the space:

While this is certainly a hot topic right now, deregulation likely won’t take full effect for another several months as the new rules are finalized by the Feds. Consumers might not feel effects of the deregulation for another year or more. Nevertheless, advertisers need to be aware of the potential changes they may face as a result of this deregulation.

First, the growth that OTT has experienced in the last few years (if you don’t know what we’re talking about, check out last week’s blogpost on OTT) may slow down. If broadband companies decide to charge OTT providers like Amazon, Netflix or Hulu more to allow their content to be served at high speed, those charges will be passed on to the consumer. And, as we saw with rising cable costs birthing more cord-cutters and cord-nevers, this could cause a dip or at least slow the growth of OTT content consumption.

Secondly, we may see a decrease in inventory that causes rising advertising costs. If viewers are leaving the OTT space, for example, there will be fewer impressions available to purchase and rates will increase as supply decreases. (Thank you, Econ 101.)

Another example from the programmatic digital ad space: Let’s say you have a client that advertises on a very niche, small network of sites to reach their target audience. Well, if any of those sites are put in the “slow lane” because the network isn’t bundled in to the ISP’s group of high-speed sites, you’ll have fewer ad impressions served there, causing higher CPMs.

Or—instead of passing the costs on to the consumer—networks and platforms could choose to pass their increased cost to be in the “fast lane” directly on to the advertiser. Even if the inventory is there, it could still theoretically cost the advertiser more to be there.

One way or another, I anticipate seeing an increase in digital advertising rates as the deregulation takes full effect in the next year or two. Advertisers and people in the media industry should be aware of the change and how it may possibly have an impact on their lives and businesses.